ISOTeam trades near 4 year low despite record order books and bright outlook (10 Jan 19)

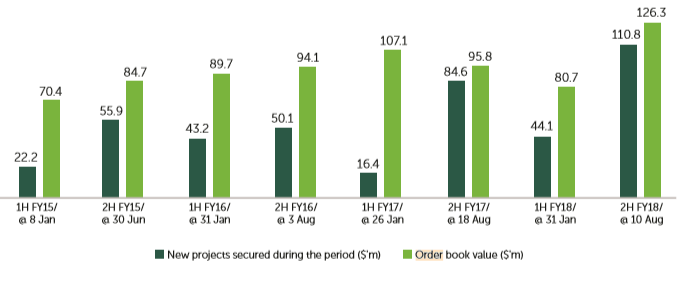

ISOTeam (“ISO”) caught my attention. Despite sitting on a record order book, ISO has tumbled approximately 44% from an intra-day high of $0.385 on 10 Apr 2018 to close near a four year low at around $0.215 on 10 Jan 2019. The share price decline was attributable in part to its 4QFY18 surprise loss announced in Aug 2018 (financial year ends in Jun). Nevertheless, my gut feel is that 4QFY18 should mark the trough in earnings and results should improve on a quarter on quarter basis in the next few quarters. As this company is a potential turnaround play, I […]