STI slumps 198 points after hitting a decade high of 3,642 on 2 May! (30 May 18)

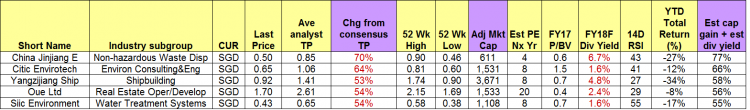

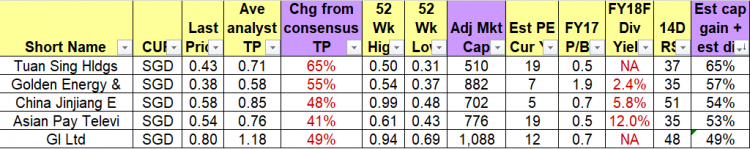

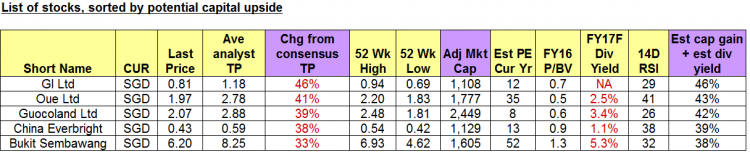

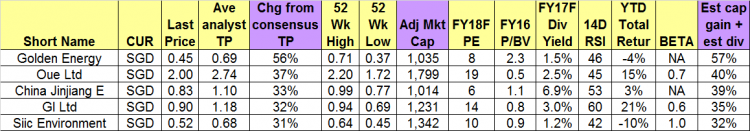

With reference to my market outlook HERE posted on 11 May 2018, I mentioned at that time that I have started to sell into strength, as I am cautious on the overall market. Clients would have been aware / notified that I have already reduced my percentage invested to <60% early last week. STI has since dropped 126 points from 3,570 on 11 May 2018 to close 3,444 on 30 May 2018. For those who wish to accumulate on weakness, I have compiled a list of stocks here, using Bloomberg’s data as of 30 May 2018. The criteria for compilation […]