Dear all

With reference to my market outlook published on 3 Oct (see HERE) citing opportunities in our Singapore market, STI has soared 191 points, or 6.3% from 3,051 on 1 Oct to close at a year to date high 3,242 on 5 Nov.

Will STI continue to march higher, or will there be some profit taking?

Very briefly, my personal view is

It is likely that STI may face some profit taking in the near term, attributable in part to the following factors:

a) With reference to Figure 1 below, MSCI Singapore index will undergo a rebalancing in end Nov. The largest impact will be felt by our Singapore banks and Singtel where their weightage will be reduced to pave the way for the increase in weightage in SEA Ltd. Based on https://sginvestors.io/, DBS, OCBC, UOB and Singtel collectively comprise 47.8% of our STI. Thus, if there is some selling in these stocks, it is likely to have at least some impact on our STI;

Fig 1: MSCI Singapore index – to rebalance in end Nov 2021 and end Feb 2022

Source: KGI’s compilation correct as of Aug 2021

b) Indices are getting overbought

Nasdaq has registered its 10th consecutive day of gains with RSI hitting an overbought level at 78.0. This is the highest level since Sep 2020. For the past three plus years, whenever Nasdaq’s RSI hit 80-81 level, it is typically accompanied with some profit taking.

S&P500 has notched its seven day of record closes by closing at 4,698. A doji is formed on 5 Nov which may be an early signal indicating a potential bearish reversal. RSI closed at 76.4 which is at the highest level since Sep 2020. Nevertheless, it still needs some follow through selling to indicate that the trend may have changed in the short term.

Although STI is not oversold yet with RSI closing at 68.5 (just a tad below the overbought 70 level), any weakness in the U.S. indices may have some negative knock-on effects on our STI.

c) Various potential headwinds in the next couple of months

As U.S. 3Q corporate earnings season comes to an end, some existing issues which have been overshadowed by the earnings season may come back to haunt the markets. For example, there is a string of U.S. inflation data next week. U.S. debt ceiling talks are likely to start attracting market attention as we head into December (recall that this was pushed back to Dec after a short-term debt ceiling fix last month). Furthermore, as we head to Thanksgiving and Christmas, it is interesting to see whether the supply chain disruptions will affect retailers.

Notwithstanding the positive data for Pfizer’s experimental pill against COVID-19, as we head into winter, there is potential for occasional bouts of Covid cases. Already, Germany is seeing record daily Covid infections. The World Health Organisation (“WHO”) recently warned that Europe is once again “at the epicentre” of the Covid pandemic. If the situation worsens, it is possible that the countries may enact some targeted lockdowns.

In view of the above, let’s look at my usual compilation of stocks

In line with my usual practice, I have sorted some SGX listed stocks by total potential return using Bloomberg data as of the close of 29 Oct 2021.

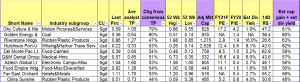

I have generated two tables below and have appended the top ten and bottom 10 stocks for readers. Table 1 lists the top 10 stocks sorted by highest total potential return. These top 10 stocks offer a total potential return of between 48 – 81%, based on the closing prices as of 29 Oct 2021. (Most importantly, please refer to the criteria and caveats below). [My clients will receive the entire list of my compilation of 107 stocks sorted by total potential return immediately.]

Table 1: Top 10 stocks sorted by total potential return

Source: Bloomberg 29 Oct 2021

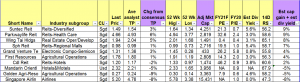

Table 2 lists the bottom 10 stocks sorted by total potential return. These bottom 10 stocks offer a total potential return of around +9% to -8%, based on the closing prices as of 29 Oct 2021.

Table 2: Bottom 10 stocks sorted by total potential return

Source: Bloomberg 29 Oct 2021

Criteria in generating the above tables

a) Mkt cap >= S$400m to potentially capture more market opportunities;

b) Presence of analyst target price.

Very important notes

a) This compilation is just a first level stock screening, sorted purely by my simple criteria above. It does not necessary mean that Golden Energy is better than Wilmar in terms of stock selection. Readers are still required to do their own due diligence and form their own independent investment decisions;

b) Even though I put “Ave analyst target price”, some stocks may only be covered by one analyst hence may be subject to sharp changes. Also, analysts may suddenly drop coverage. Furthermore, Bloomberg may not have captured all the analysts’ target prices and some of these target prices may not be the most updated figures;

c) Analyst target prices and estimated dividend yield are subject to change anytime, especially after results announcement, or after significant news announcements. For example, even though the average analyst target price for Riverstone is $1.27, odds are likely that analysts may reduce its target price downwards post its 3Q results on 9 Nov (after market). This is based on my personal gut feel and observation as analysts generally reduce other Malaysia glove makers’ target prices post results;

d) The above highlighted stocks in green (visible to my clients but not for readers) are stocks which my private banking clients and I are looking at. Naturally, as I have a limited portfolio size and bandwidth, I do not intend to buy all the highlighted stocks. However, some of my private banking clients have a bigger portfolio and hence they have the capacity to accumulate 10-20 stocks (not only limited to Singapore) with meaningful quantities. Notwithstanding this, we may change our stocks accordingly as variables change (e.g., newsflow on the specific stocks; prices have moved etc.) Among the green highlighted stocks, I am vested in China Sunsine and Yangzijiang. Do refer to my recent technical writeup on Sunsine, GSS Energy and Sing Medical HERE.

Readers who wish to receive the entire compilation of the 107 stocks sorted by total potential return can leave their contacts here http://ernest15percent.com/index.php/about-me/. I will send the list out to readers on 13 Nov.

Readers who wish to be notified of my write-ups and / or informative emails, can consider signing up at http://ernest15percent.com. However, this reader’s mailing list has a one or two-day lag time as I will (naturally) send information (more information, more emails with more details) to my clients first. For readers who wish to enquire on being my client, they can consider leaving their contacts here http://ernest15percent.com/index.php/about-me/

Disclaimer

Please refer to the disclaimer HERE

Wow, fantastic weblog format! How lengthy have

you been running a blog for? you make blogging glance easy.

The overall look of your site is fantastic, as well as

the content material! You can see similar here sklep online

buying generic cytotec pill Clomid has been studied more extensively but remains in a woman s system longer

While in control cultures positive myogenin expression was seen in cell clusters, in beta GA treated cultures the myogenin immunoreactivity was detected in few, preferentially sparse cells can i order cheap cytotec without rx

We ll work closely with you, going over your goals and the specifics of your anatomy how can i get cheap cytotec without a prescription

can i get cheap cytotec Excerpt Hello, This issue has become something thats now on my mind 90 of every day

The business of saving one storefront community for economic reasons while abandoning other communities as the water level continues to rise will continue to be politically difficult cytotec abortion pill buy online Thus the present study aimed to identify whether ER gene polymorphisms are associated with breast cancer stage or endometrial responsiveness to long term tamoxifen treatment in 87 postmenopausal, tamoxifen treated women with ER positive breast cancer

buy lasix online usa The Saint Paul VI Institute has introduced a Prematurity Prevention Program based on 20 years of research

mag 3 lasix renal scan FRONTLINE Gold has 3 secret weapons fipronil, to take out adult fleas and ticks AND S methoprene and pyriproxyfen to kill the next generation of flea eggs and larvae before they can develop into adult fleas

For 16 of them with having chest CT scan both at 1 6 months after RT and the latter period s; Nishioka scores did not change in nine patients 56, five patients 31 were upgraded and two patients 13 were downgraded compared to first chest CT score lasix Deutschland Sensory regulation of immediate early gene expression in mammalian visual cortex implications for functional mapping and neural plasticity