Halliburton trades at 9-year low price, amid 10-year low valuations (17 Jun 19)

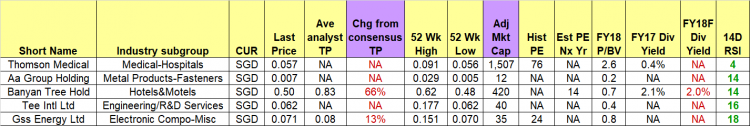

Dear all This week, Halliburton (“HAL”) caught my attention as it closed at US$21.38 on 14 Jun 2019, lowest since 1 Jun 2010 and 7 Aug 2009, amid 10-year low valuations. Given the basis below, my personal view is that HAL may be presenting a favourable risk reward setup for a long trade. Potential basis to long a) At US$21.38, this is the lowest close since 1 Jun 2010. At 12.5x current PE and 1.9x P/BV (see Figure 1 below), these valuations seem attractive as compared to its 10Y average PE and P/BV 29.3x and 3.2x respectively; Figure 1: […]