Raffles Medical – Potential trading play as its results are just around the corner (20 Feb 23)

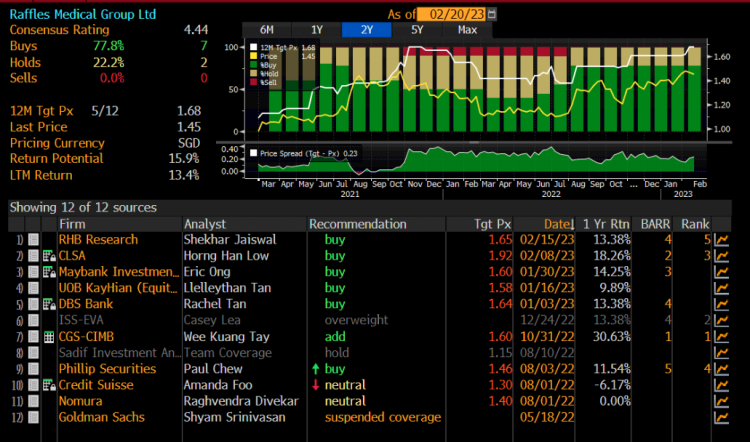

Dear all, Raffles Medical caught my attention recently as CLSA raised its target price from $1.70 to $1.92 on 8 Feb 23. $1.92 is a street high target with most analysts’ target price ranging between $1.58 – 1.65. Raffles Medical closed down 1 cent to $1.45 last Fri. Based on my personal view and observation, generally speaking, analysts seldom issue updated call so near to the company’s results release date. I mean there is usually no such urgency to do so, unless they have a significant change in view on the company. For those analysts who do, their calls are […]