STI – having closed at a record YTD high, will it continue higher? (7 Nov 2021)

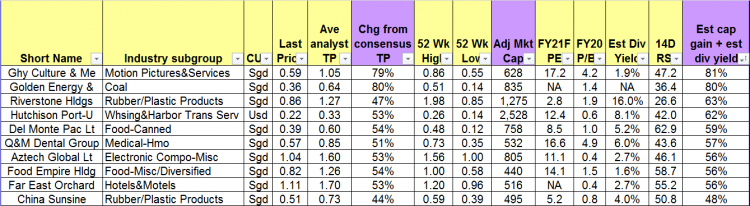

Dear all With reference to my market outlook published on 3 Oct (see HERE) citing opportunities in our Singapore market, STI has soared 191 points, or 6.3% from 3,051 on 1 Oct to close at a year to date high 3,242 on 5 Nov. Will STI continue to march higher, or will there be some profit taking? Very briefly, my personal view is It is likely that STI may face some profit taking in the near term, attributable in part to the following factors: a) With reference to Figure 1 below, MSCI Singapore index will undergo a rebalancing in […]