Oxley – poised to benefit from Singapore’s property market upturn (10 Apr 18)

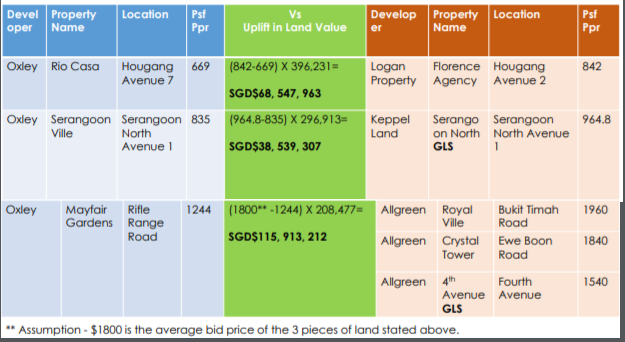

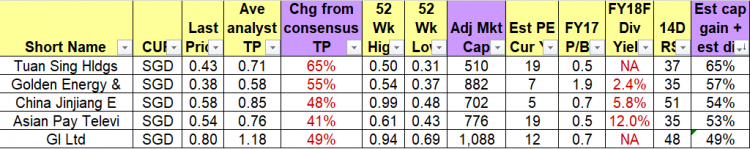

Dear all, Do you know that Oxley has the largest residential land bank in Singapore by number of dwelling units, based on an article in the Business times dated 23 Jan 2018? Based on a flash estimate from the Urban Redevelopment Authority, Singapore private home property prices jumped 3.1% in the three months to Mar 2018. This was the fastest since 2010. Notwithstanding such buoyant sentiment in home prices, Oxley’s share price has recently dropped to near six month low levels. Thus, I think it may be worthwhile to take a look at Oxley. First, a description of Oxley […]