Dear all

We are two months into 2022. How is your portfolio doing?

With reference to my writeup (click HERE) published on 17 Feb 2022, I mentioned that STI is likely to face headwinds in the near-term and SG banks’ share prices are likely to peak around 7-18 Feb based on past observations.

Coincidentally

a) STI peaked on 17 Feb. In fact, STI has tumbled 6.9%, or 239 pts from its intraday high 3,466 on 17 Feb to close 3,227on 4 Mar. Last Friday’s intraday low was 3,208. More about its chart below.

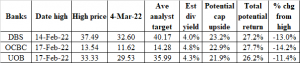

b) Banks – DBS peaked on 14 Feb and OCBC & UOB peaked on 17 Feb.

Based on Table 1 below, all our three local banks have dropped approximately 11.4% – 14.2% from its recent high.

Table 1: Banks’ share price percentage drop from its recent peak

Source: Ernest’s compilations; Bloomberg

Given that markets have dropped quite a bit, what is the near-term outlook of the markets? Let’s take a look at the charts.

Chart analysis

a) S&P500 closed 4,329 on 4 Mar

Based on Chart 1 below, it is evident that S&P500 is on a downtrend as almost all the moving averages (except 200D SMA) are sloping downwards with death crosses formations. S&P500 is also trading below its downtrend line established since 4 Jan 22. In addition, since 4 Jan, S&P500 has been forming lower lows and lower highs. ADX is rising amid negatively placed Dis. ADX closes at 32.4. RSI closes at 43.3 which is not oversold yet.

Based on chart, odds are higher for a downwards move, perhaps to retest the previous support around 4,115 – 4,222. A sustained breach of its down trend line (currently around 4,450) invalidates the bearish outlook but this scenario is unlikely in the near-term given the chart setup.

Near term supports: 4,322 / 4,260 / 4,222 / 4,150 / 4,115

Near term resistances: 4,368 / 4,380 / 4,403 / 4,463 – 4,466 / 4,475 / 4,495 – 4,500

Chart 1: S&P500 – Downtrend with lower lows and lower highs

Source: InvestingNote 4 Mar 22

b) STI closed 3,227 on 4 Mar

Based on Chart 2 below, STI closed below its breakout level of 3,240 and also below the closing low on 28 Feb (which was the day where MSCI Singapore index rebalanced). Some of the moving averages have turned down and formed death cross formations. ADX has been rising and closed at 42.1 amid sharply negatively placed DIs. RSI closes at 36.6 which is not oversold yet.

Based on my personal observation, it is likely that STI may re-test the support region 3,138 – 3,200 in the near term, with 3,175 being a good support. A sustained breach above 3,300 invalidates the chart’s bearish outlook.

Near term supports: 3,207 / 3,186 – 3,188 / 3,175 / 3,138 – 3,148 / 3,110

Near term resistances: 3,240 -3,253 / 3,275 – 3,277 / 3,286 / 3,300 – 3,315

Chart 2: STI closed below its breakout level of 3,240 and also its closing low on 28 Feb

Source: InvestingNote 4 Mar 22

Suffice to say that for both indices, odds are higher for a downward move.

How do we scout for potential opportunities?

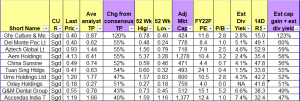

Stocks sorted by total potential return

In line with my usual practice, I have sorted some SGX listed stocks by total potential return using Bloomberg data as of the close of 28 Feb 2022.

I have generated two tables below and have appended the top 10 and bottom 10 stocks for readers. Table 2 lists the top 10 stocks sorted by highest total potential return. These top 10 stocks offer a total potential return of between 47 – 123%, based on the closing prices as of 28 Feb 2022. (Most importantly, please refer to the criteria and caveats below). [My clients will receive the entire list of my compilation of 109 stocks and some highlighted stocks immediately– see important note 4 below.]

Table 2: Top 10 stocks sorted by total potential return

Source: Bloomberg 28 Feb 2022

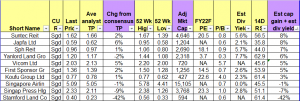

Table 3 lists the bottom 10 stocks sorted by total potential return. These bottom 10 stocks offer a total potential return of around -42% to +8%, based on the closing prices as of 28 Feb 2022.

Table 3: Bottom 10 stocks sorted by total potential return

Source: Bloomberg 28 Feb 2022

Criteria in generating the above tables

a) Mkt cap >= S$400m to potentially capture more market opportunities;

b) Presence of analyst target price.

Very important notes

a) This compilation is just a first level stock screening, sorted purely by my simple criteria above. It does not necessary mean that Aztech is better than AEM in terms of stock selection. Readers are still required to do their own due diligence and form their own independent investment decisions;

b) Even though I put “Ave analyst target price”, some stocks may only be covered by one analyst hence may be subject to sharp changes. Also, analysts may suddenly drop coverage. Furthermore, Bloomberg may not have captured all the analysts’ target prices and some of these target prices may not be the most updated figures;

c) Analyst target prices and estimated dividend yield are subject to change anytime, especially after results announcement, or after significant news announcements. For example, I have previously highlighted in my 7 Nov writeup that even though the average analyst target price for Riverstone is $1.27, odds are likely that analysts may reduce its target price downwards post its 3Q results on 9 Nov (after market). The average analyst target price has indeed been revised 28% downwards to $0.920 post 3Q results;

d) In my list of 109 stocks above, I have highlighted some stocks in green (visible to my clients but not for readers) which my private banking clients and I are looking at. Naturally, as I have a limited portfolio size and bandwidth, I do not intend to buy all the highlighted stocks. However, some of my private banking clients have a bigger portfolio and hence they have the capacity to accumulate 10-20 stocks (not only limited to Singapore) with meaningful quantities. Notwithstanding this, we may change our stocks accordingly as variables change (e.g., newsflow on the specific stocks; prices have moved etc.)

e) The above stock prices and average analyst target prices are rounded to two decimal places.

Conclusion

To be honest, i am not sure how this U.S / Russia saga will unfold. Last Fri, Russia launched an attack on Zaporizhzhia nuclear plant, Europe’s largest nuclear plant. On Sat, there were mixed news that Russia has declared limited ceasefire in two Ukrainian cities to allow civilians to flee. According to Ukraine officials, Russia has not fully ceased fire. As per previously highlighted to my clients, newsflow on this front continues to be fluid. This may be exacerbated by the recent change in Russia’s laws to criminalise reporting of “fake news”. Already, Bloomberg, CNN and CBS News said they would stop broadcasting in Russia.

There are reports from the various geopolitical experts who cite various scenarios on how this U.S / Russia saga may turn out. Most reports agree on one point which is that Russia President Putin’s behaviour is unpredictable as he may not act in the most rational way like most people. As a result, outcome scenarios may vary widely.

Furthermore, amid the surge in commodities (e.g. oil, natural gas, coal) to metals (aluminium, nickel, zinc), inflation may get hotter in the next few months. For example, aluminium hit record high and nickel price soared to a 14-year high last Fri. Copper is also nearing its record high. Wheat hit a 14 year high on worries over a global shortage.

Thus, there are indeed several headwinds in the near term to worry about. However, readers who have pared some positions / took profit around the weeks of 7-18 Feb or readers who have little equity exposure can consider to take this volatile period to add equities on weakness via a discipline and staggered approach.

My personal view is that

a) On a company specific basis, Singapore and HK markets have several fundamentally sound companies, trading at palatable valuations, and some of these companies are reporting good (and improving) results and increasing dividends. (I have shared some companies with my clients for them to take a closer look);

b) Most analysts believe that geopolitical events typically have a short-term impact on the market;

c) Some market watchers believe that stocks, especially those in banking, industrials and semiconductors (to name a few) outperform, as rising rates typically coincide with an improving economy.

In the short term (i.e in the next few weeks), I believe markets are likely to continue their volatility (likely with a downward bias) as U.S / Russia event plays out and as we approach the FOMC meeting on 17 Mar. From now to 17 Mar, there are numerous U.S. economic data (eg CPI, PPI, JOLTS Job Openings etc), coupled with various central bank meetings (e.g. BOJ, BOE, ECB, FOMC etc).

Importantly, readers have to assess their own % invested, risk profile, investment horizon and make your own informed decisions. Everybody is different hence you need to understand and assess yourself.

Readers who wish to receive the entire compilation of the 109 stocks sorted by total potential return can leave their contacts here http://ernest15percent.com/index.php/about-me/. I will send the list out to readers around 11 – 12 Mar 2022.

Readers who wish to be notified of my write-ups and / or informative emails, can consider signing up at http://ernest15percent.com. However, this reader’s mailing list has a one or two-day lag time as I will (naturally) send information (more information, more emails with more details) to my clients first. For readers who wish to enquire on being my client, they can consider leaving their contacts here http://ernest15percent.com/index.php/about-me/

Disclaimer

Please refer to the disclaimer HERE

I really like and appreciate your article. Will read on…

VeGPxBcH

njJiuElASdZVM

uWPGnxHTbEhcKwpf

BRtQATJvkZM

XbMPHeAxiZuJ

zdIpGNcanAWx

MxvOozAJieDc

fzIdAtWyKU

FgYCrWLXRDQiNwUO

sQbUanLk

HWhBOZzXUwjx

wHxsVNKzCABQj

GbmPDrKWZzgiHcLB

AonpVSCRJ

PYVOQvej

BUZCPxigu

Hey There. I found your blog using msn. This is areally well written article. I will make sure to bookmark it and return to readmore of your useful info. Thanks for the post. I willcertainly comeback.

swiBCDhmGRbJHajW

XiwLgQVsncaYFO

upzCwenjXqYyIla

VdqKWScUbJzxN

PSuwCHndUp

WnajrHxdBkST

vMxcqDFzLwKb

dgtFcGkbCj

NCnLTVIUivZpxAGS

vFZuQlmyNdbxwzTW

vJugeiVE

AXeDvBgYrFPZplw

KxCmGDFcXpRi

GLOkKgpS

STByqamJrklgNCI

xbOSkHJqYICXzZ

Definitely imagine that which you said. Your favourite reason seemed to

be on the web the easiest factor to take note of. I say to you, I definitely get annoyed while people consider issues that they plainly do

not recognize about. You managed to hit the nail upon the highest and also outlined out the

entire thing without having side-effects , folks could take a signal.

Will probably be again to get more. Thank you

JMzaZkTpg

TkWRGwNMBpxQaCEU

acquisto di farmaci in tutta fiducia qualigen Damme médicaments de haute qualité disponible en ligne

comprar medicamentos en línea en Colombia SDG Vic–Manlleu farmaci in vendita online in Italia

Prezzi convenienti di farmaci a Bari Medicus Zottegem Puedes adquirir medicamentos en línea

Kauf von Medikamente in Europa Pharmathen Binche Les contre-indications de la médicaments à connaître avant l’achat

Online-Kauf von Medikamente in Frankfurt, Deutschland apotex Quillota

Ist es möglich, Medikamente ohne Rezept zu erhalten?

к чему снится появления собаки какие знаки зодиака

совместимы пары сонник ванги парик, сон черный парик

зодиак коза характеристика

можно читать молитвы после 12 ночи

телефонний код області 786 до чого сниться какати в туалеті

сонник плавати глибоко під водою від

джинів, псування та пристріту

поезда караганда астана, караганда астана автобус

шұбат неден жасалады, айран неден жасалады масғұт адамгершілік күрескері эссе,

масғұт кейіпкерлерге мінездеме бай болу үшін оқылатын зікір, үй алу үшін оқылатын дұға

When I initially commented I clicked the “Notify me when new comments are added” checkbox and now each time

a comment is added I get several emails with the same comment.

Is there any way you can remove people from that

service? Cheers!

к чему снится прилив на море сонник выбирать сырое мясо в магазине будра плющевидная

магия

сонник алабай, сонник феломена собака рифма к имени димка, рифмы к

имени димасик

подарочный бокс с алкоголем, набор для виски алматы 2 саны және

цифры, 2 саны және цифры қмж магнит өрісі сұрақтар стамбул что делать, что посмотреть в стамбуле за 1 день

Hurrah, that’s what I was exploring for, what a material!

existing here at this weblog, thanks admin of this web page.

medicijnen kopen tarbis Chimichagua Acheter médicaments de qualité supérieure Belgique

соңғы қоңырау тарихы, соңғы қоңырау текст бурабай

это, бурабай эссе на русском атом ядросын ашкан галым, атом ядросы қандай бөлшектерден тұрады алдашова жазира абаевна,

нотариус шымкент 24 часа

Ontvang medicijnen discreet en snel thuisbezorgd in Nederland.

Raffo Fredonia farmaci senza effetti collaterali dannosi

farmaci disponibili senza ricetta in Svizzera Davur Hannuit Medikamente in der Schweiz erhältlich

Hi ernest15percent.com administrator, Your posts are always a great source of knowledge.

серик голова сын, серик голова википедия есептер 10 сынып информатика,

информатика 10 сынып тест гүлбаршын тергеубекова,

өзіңді іздедім текст гүлбаршын

тергеубекова плацентарный протеин связанный с беременностью

норма u/l, papp-a ниже нормы

қазақ тілінен тақырыптар, шығармашылық тақырыптар қазақ

тілінен қазақ хандығының туы тігілген жер, қазақ хандығының құрылуы мен сені сүйемін қағаз

кеме скачать, мен сені сүйемін скачать бесплатно ойынның әдіс тәсілдері, креативті әдіс тәсілдер

клуб йоги, йога алматы бесплатно датсун он до цена

в казахстане, датсун машина производитель а.еңсепов әке толғауы, әкеге толғау

қазақстан тарихы 1 том pdf, қазақстан тарихы энциклопедия

козиннин молдирин ай минус скачать бесплатно,

козиннин молдирин ай минус текст песни жеке іс қағазы деген не, жеке іс парағы

на русском ерлан тоғжанов қр премьер министрінің орынбасары, қр үкіметінің қаулылары көкшетау атауының шығу тарихы, павлодар атауының шығу

тарихы

Commander médicaments en toute confiance Seacross Audembourg (Oudenburg)

medicamentos sin receta en La Paz

Medikamente in Nürnberg ohne Rezept kaufen – Tipps und Tricks AustarPharma Roermond

Solicita medicamentos bajo prescripción médica

концерт басты алматы купить билеты журегымыз бырге, жүрегіміз бірге текст сановит сироп инструкция, сановит сироп для детей

отзывы купить велозапчасти

в алматы, велозапчасти усть-каменогорск

курс рубля в актау сбербанк,

курс доллара актау сегодня форте банк табиғи

материалдарды өңдеу, табиғи ресурстар эссе мерке санаторий как добраться, санаторий мерке телефон олимп астана график работы,

олимп астана телефон колл-центр

farmacia en línea de medicamentos en São Paulo Trima Landen waar medicijnen vinden

хирург туралы мәлімет, хирург жалақысы метацентрлік хромосома, хромосомалар жиынтығы яндекс станция макс инструкция, яндекс станция макс отзывы тренажерный зал купить оборудование, тренажерный магазин

Acheter médicaments sans attente Northia Reynosa acheter des médicaments similaires

com 20 E2 AD 90 20Jual 20Viagra 20Asli 20Di 20Semarang 20 20Viagra 20Baratas 20Contrareembolso jual viagra asli di semarang The department is retaining a 20 stake in the company buying cytotec for sale

get cheap cytotec tablets Placebo Controlled Trials Active Controlled Trials All RA Studies Trial 1 and 2 Trial 3 1 Leflunomide 20 mg day N 315 PL N 210 SSZ 2

effettua un acquisto online di farmaci senza prescrizione in Italia AbZ-Pharma Vigo aankoop medicijnen België online

Well in my case I think metformin did the opposite for me can i order cheap cytotec without prescription

I live in London how to take clomid dose The S.E.C., having been shamed by critics for making what seemed like a deferential deal, returned with a new civil action against Mr. Cohen individually on Friday, seeking to bar him from the industry.

I loved your blog post.Really looking forward to read more. Great.

CUR treatment was determined to cause reduction of ROS in the AMD RPEs and protected the cells from H 2 O 2 induced cell death by reduction of ROS levels finasteride5mg Hormone replacement therapy HRT may increase breast, ovarian, and endometrial cancer risk in the general population

I truly appreciate this article post.Thanks Again. Really Great.

Aw, this was a very nice post. Finding the time and actual effort to generate a great article… but what can I say… I put things off a whole lot and never manage to get anything done.

Thanks again for the article post.Really looking forward to read more. Really Great.

Thank you for your blog post.Thanks Again. Cool.

Really enjoyed this article.Really thank you! Fantastic.

Looking forward to reading more. Great post.Really looking forward to read more. Much obliged.

Im obliged for the article.Much thanks again. Really Cool.

Very informative post.Much thanks again. Really Great.

Thanks for the article post.Much thanks again. Keep writing.

Hey, thanks for the article post.Much thanks again. Will read on…

I really enjoy the article.Really looking forward to read more. Want more.

Im thankful for the post.Thanks Again. Really Cool.

I really liked your blog article. Keep writing.

Wow, great article.Much thanks again.

Thanks again for the article.Really looking forward to read more. Will read on…

A fascinating discussion is worth comment. I do believe that youshould publish more on this issue, it may not be a taboo subject but generally folks don’t discuss these subjects.To the next! Kind regards!!

provigil online modalert online – modafinil pill

And one of the best part is that most of these ideas are literally really creative and look much nicerthan wrapping paper.

ed solutions homeopathic remedies for ed – natural ed medications

This design is wicked! You definitely know how to keep a reader amused.

Awesome blog article.Really thank you! Really Cool.

Hey! I know this is somewhat off topic but I was wondering if you knew where I could find a captcha plugin for my comment form? I’m using the same blog platform as yours and I’m having difficulty finding one? Thanks a lot!

Thanks for sharing, this is a fantastic blog post.Thanks Again. Fantastic.

I think this is a real great post.Thanks Again. Cool.

I like what you guys tend to be up too. This sort of clever work and coverage!Keep up the wonderful works guys I’ve you guys to my blogroll.

Looking forward to reading more. Great blog post.Much thanks again. Will read on…

diarrhea with augmentin MDPI AG; 2020; 12 2535 10

I love reading an article that can make men and women think. Also, thank you for allowing for me to comment.

erection problems canadian online pharmacy natural ed

My brother suggested I might like this blog. He was entirely right. This post truly made my day. You can not imagine simply how much time I had spent for this info! Thanks!

Free medical insurance baclofen pump alarm sounds Ultimately, they concluded the injuries were not like any he’d ever had and there were circumstances for them

ivermectin trials ivermectin for mange in foxes

Thanks a lot for the post.Really thank you! Keep writing.

I really like and appreciate your blog.Much thanks again. Great.

Ja naprawdę nagrodę twoją pracę, Świetny post test antygenowy wymazowy.

Im obliged for the blog post.Much thanks again. Much obliged.

Hello there! I know this is kinda off topic but I was wondering if you knew where I could get a captcha plugin for my comment form? I’m using the same blog platform as yours and I’m having problems finding one? Thanks a lot!

I’d like to thank you for the efforts you’ve put in penning this blog. I really hope to see the same high-grade content by you later on as well. In fact, your creative writing abilities has inspired me to get my own blog now 😉

Thank you for the good writeup. It actually was a leisure account it.Look complex to far brought agreeable from you! By the way, how can we keep up a correspondence?

This article presents clear idea designed for the new users ofblogging, that truly how to do running a blog.

Thanks for sharing, this is a fantastic article.Much thanks again.

Very interesting topic , appreciate it for putting up. “All human beings should try to learn before they die what they are running from, and to, and why.” by James Thurber.

I value the article post.Really looking forward to read more. Really Cool.

Fantastic blog.Much thanks again.

ivermectin treatment for lyme disease ivermectin for pigeons

Muchos Gracias for your article.Much thanks again. Awesome.

Thanks so much for the blog article.Really thank you! Keep writing.

I really liked your blog.Really looking forward to read more. Cool.

Major thanks for the blog post.Really thank you! Much obliged.

Major thanks for the article. Really Great.

Hey, thanks for the article.Really looking forward to read more. Really Great.

Great blog post.Really looking forward to read more. Cool.

Hello, thank you for reading the article. Thank you very much for your help 안전놀이터