Food Empire – potential bullish chart development amid volume expansion (11 Nov 2019)

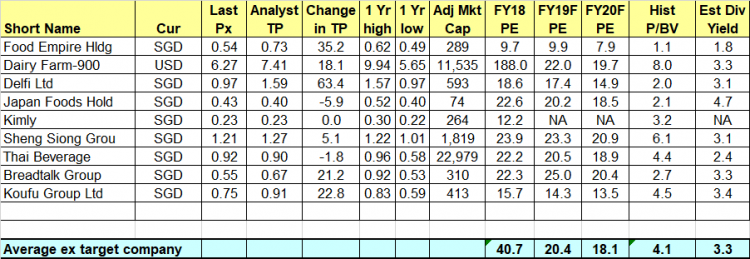

This week, Food Empire caught my attention with their potential bullish chart developments amid volume expansion. This may be an opportune time to take a look at Food Empire on the back of its potential bullish chart and strong results released this evening. Do take a look at the basis and more importantly, the risks. Basis A) Chart looks positive with strengthening indicators and volume Based on Chart 1 below, Food Empire has been trading in six-month trading range $0.490 – 0.550 and is now on the verge of challenging its key resistance around $0.550 with increasing volume. It […]