Best World – down 47% in 2 months! Buying opportunity or falling knife? (12 Apr 19)

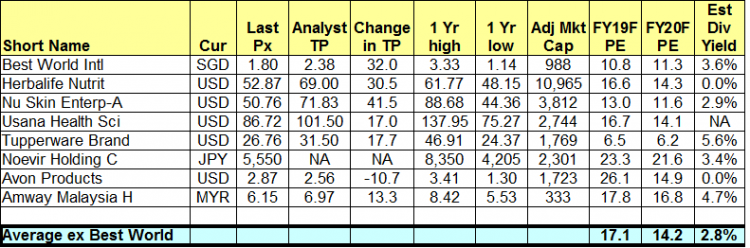

With reference to my 19 Sep 2018 write-up (click HERE), Best World has appreciated approximately 147% from $1.35 on 19 Sep 2018 to touch an intra-day high of $3.33 on 13 Feb 2019. At that time, Best World has dropped out of my watchlist after its incredible rally. However, with its recent 47% tumble from its all-time intra-day high $3.33 on 13 Feb 2019 to trade $1.76 on 12 Apr 2019, it seems interesting again. Is this a buying opportunity or falling knife? Why is it interesting? a) Valuations are more attractive now Based on Bloomberg (see Table 1), Best World […]