STI – Will it head for new YTD high after S&P500 clocked its 7th consecutive day of rally? (6 Jul 2021)

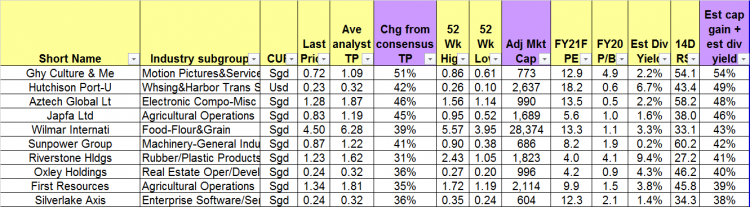

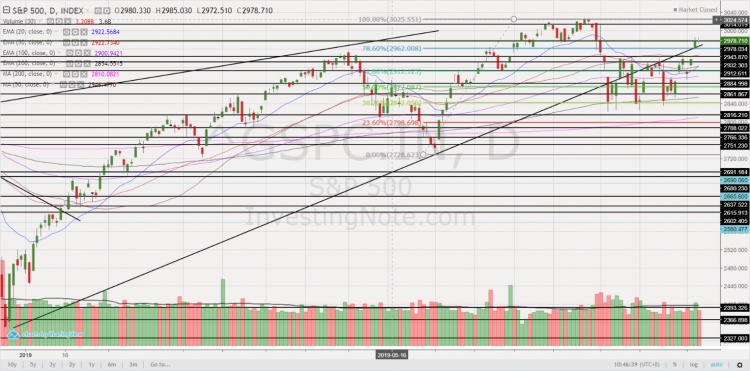

Dear all S&P500 and Nasdaq clinch fresh record highs last Friday with S&P500 clocking in seven consecutive days of gains in its longest winning streak since August 2020. Despite the roaring U.S. markets, Singapore Straits Times Index (“STI”) has slipped almost 100 points from its 2021 intraday high of 3,237 on 30 Apr 2021 to close 3,141 on 5 Jul 2021. Can STI exceed 3,237 for 2HFY2021? Most strategists believe so, as their year-end targets for STI are easily above 3,237. Let’s look at the possible reasons why analysts are positive on our Singapore market. Reasons to be optimistic […]