HPH Trust – Potential laggard in this market FOMO to buy interest rate cut beneficiaries (20 Sep 24)

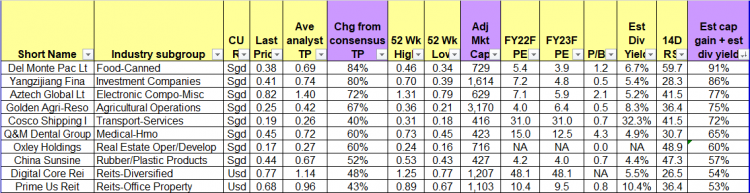

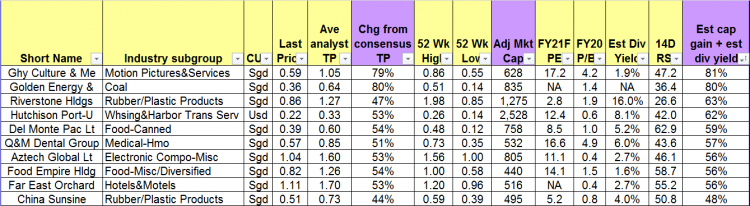

Dear all While I was doing my usual screening of stocks and sort them by price to book; estimated dividend yield and total potential return etc, one stock stood out. HPH Trust (HPHT) stood out as one of a potential laggard. It last traded at US$0.130. Read on to see why it interests me. Interesting points on HPH Trust A) Low valuations with P/BV 0.35x Based on Bloomberg, HPHT trades at 0.35x FY24F P/BV, 1.0x standard deviation below its average 10Y P/BV of 0.6x. Based on Shareinvestor, NAV / share is around US$0.367. B) Staggering yield of 12.5%! Based […]