Markets – possible technical rebound in the near term but likely short lived (26 May 2022)

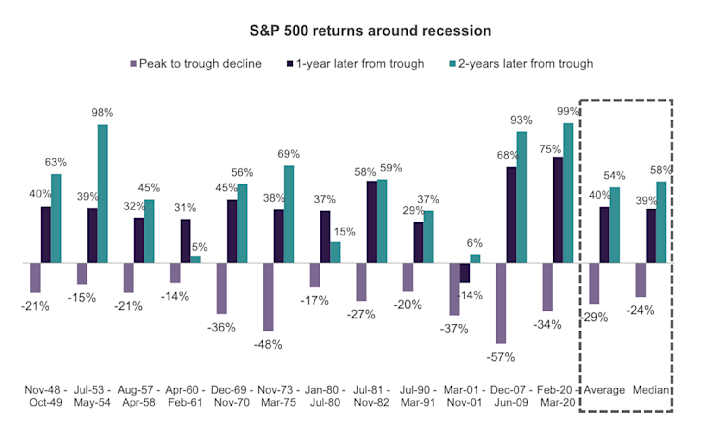

Dear all I have been extremely busy with work, hence the dearth of articles on my blog. Dow has closed lower for the eighth consecutive week. This marks the longest period of consecutive weekly losses since 1923! S&P500 has registered a seventh week of losses, its longest weekly losing streak since March 2001. Are the markets going to drop into an abyss? Or has the bottom been reached? Before we delve into this, let’s recap on my earlier market outlook article dated 4 Apr 22 (click HERE). Previously, I wrote that I am more inclined towards the bearish / prudent […]