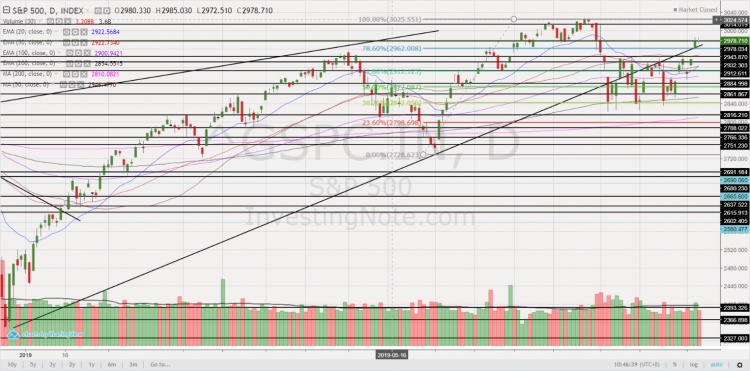

S&P500 at 2,979 – limited potential upside (8 Sep 19)

With reference to my earlier write-up (click HERE) titled “Why am I cautious going into July…”, July was coincidentally the peak for S&P500. Hang Seng touched an intraday high of 29,008 on 4 Jul 2019 before slumping 4,108 points to an intraday low of 24,900 on 15 Aug 2019 (Hang Seng closed at 26,691 on 6 Sep 2019.) Personally, given the current market levels and information, I am not comfortable to raise my current percentage invested from 53% to significant levels (say >80%). Why am I cautious in the market? Do read on… Factors supporting my cautious basis Above […]