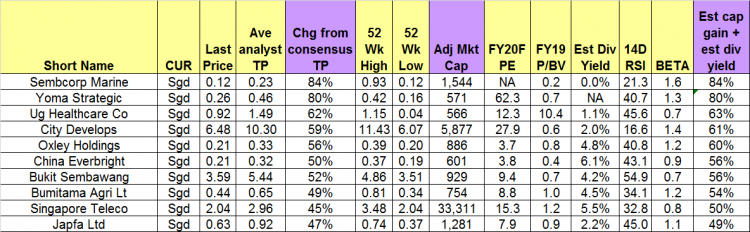

Numerous trading opportunities as Singapore corporates report results (9 Aug 2022)

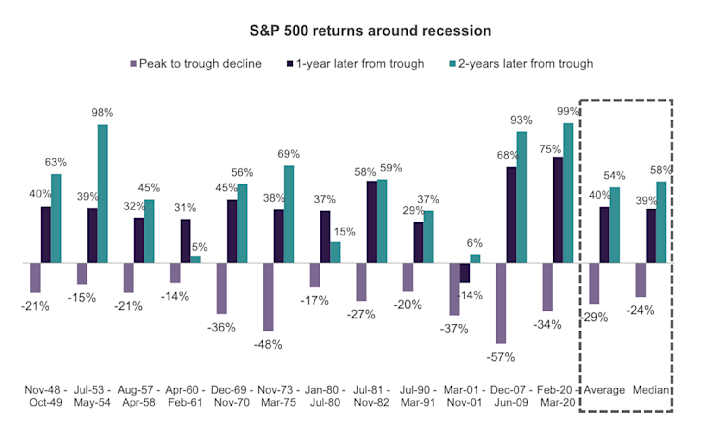

Dear all, Happy National Day! How has your portfolio been year to date? With reference to my writeup published on 3 Jul 2022 (click HERE), I mentioned that there are likely to be opportunities in the next few weeks. Post my writeup, S&P500 touched an intraday low of 3,722 on 14 Jul before closing up 418 points or 11.2% at 4,140 yesterday. In fact, S&P500 posted its best monthly gain in July, since Nov 2020. STI touched an intraday low of 3,088 on 15 Jul before trading up 183 points or 5.9% at 3,271 yesterday. Our Singapore banks started to […]