Aztech looks interesting – lowest forward PE among SG tech stocks with a 5.6% estimated dividend yield! (16 Apr 22)

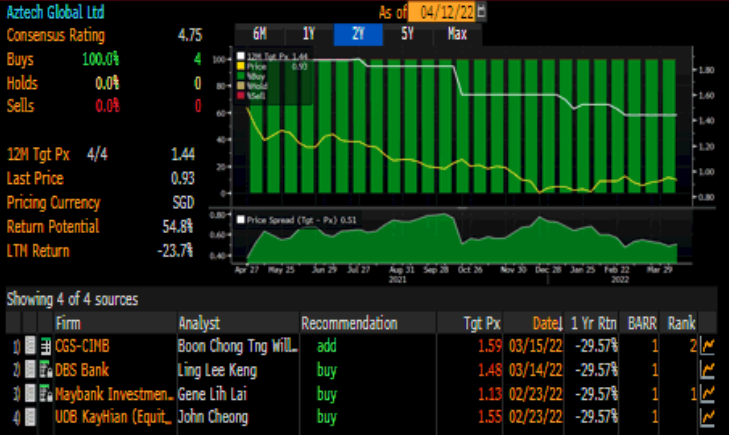

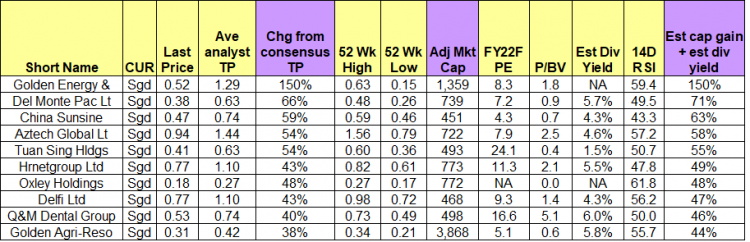

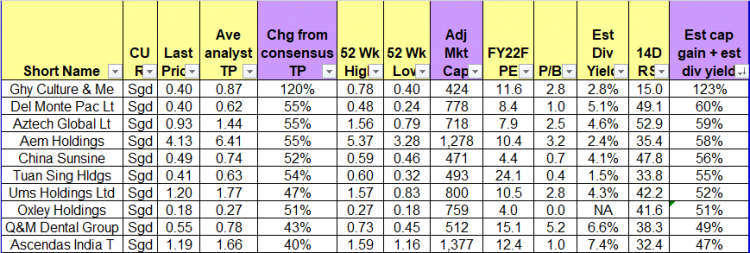

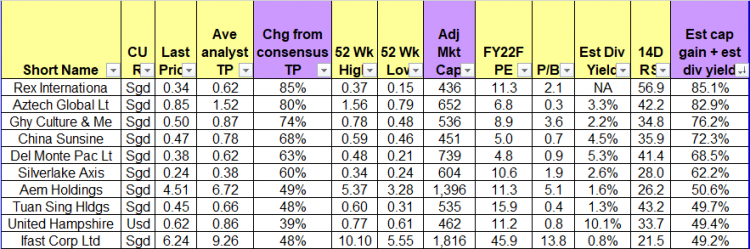

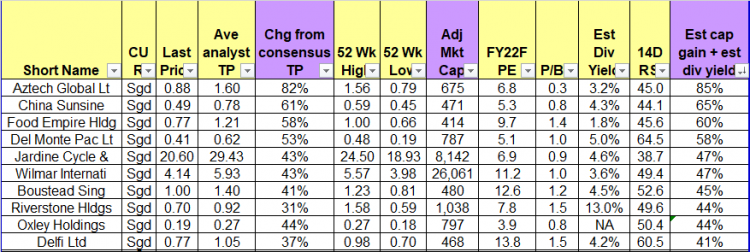

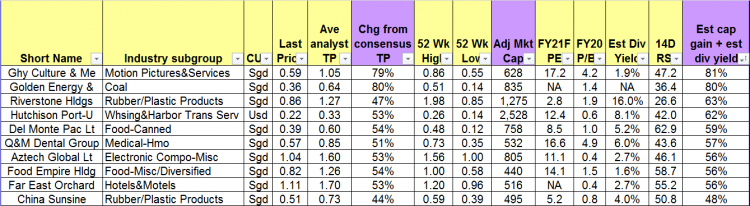

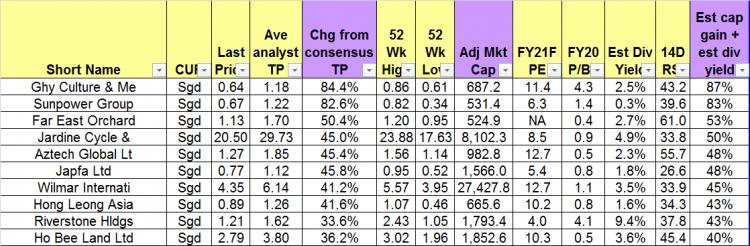

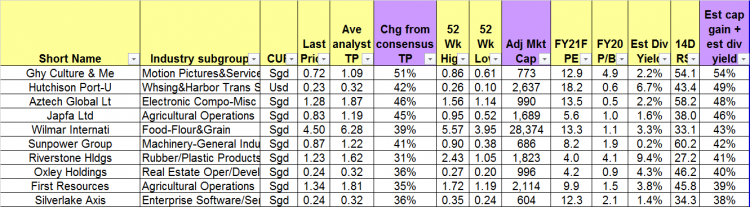

Dear all This week, Aztech has caught my attention amid rising volume with its 1QFY22F business update just around the corner. It has fallen approximately 39% from an intraday high of $1.56 on 27 Apr 2021 to close at $0.950 last Thursday. Let’s take a look on the interesting points and potential risks on Aztech. Interesting points a) Analysts like Aztech with average target price $1.44 With reference to Figure 1 below, 4 analysts cover Aztech and all rate it a buy. Average analyst target price is around $1.44. If the analysts are right, Aztech offers a potential capital […]