AEM enters bear market despite analysts’ positive calls. What gives? (20 Feb 22)

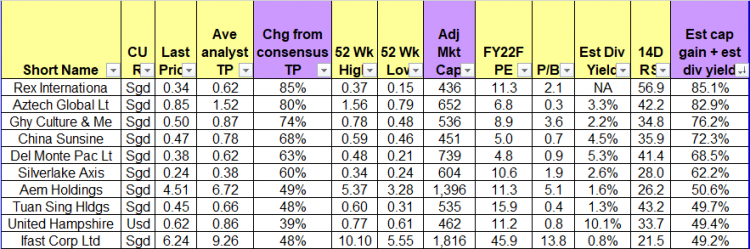

Dear all AEM has fallen 21% from an intraday high of $5.37 on 14 Dec 2021 to close $4.25 on 18 Feb 2022. What has happened in the last two months to warrant such falls? Based on Bloomberg, average analyst target price is around $6.72, representing a potential capital upside of around 58%. Is this the bottom for AEM, or will it fall further? Personally, I think AEM is worth a closer look at $4.20 – 4.30 region. Let’s take a look at its investment merits and risks. First things first, what does AEM do? According to its company […]